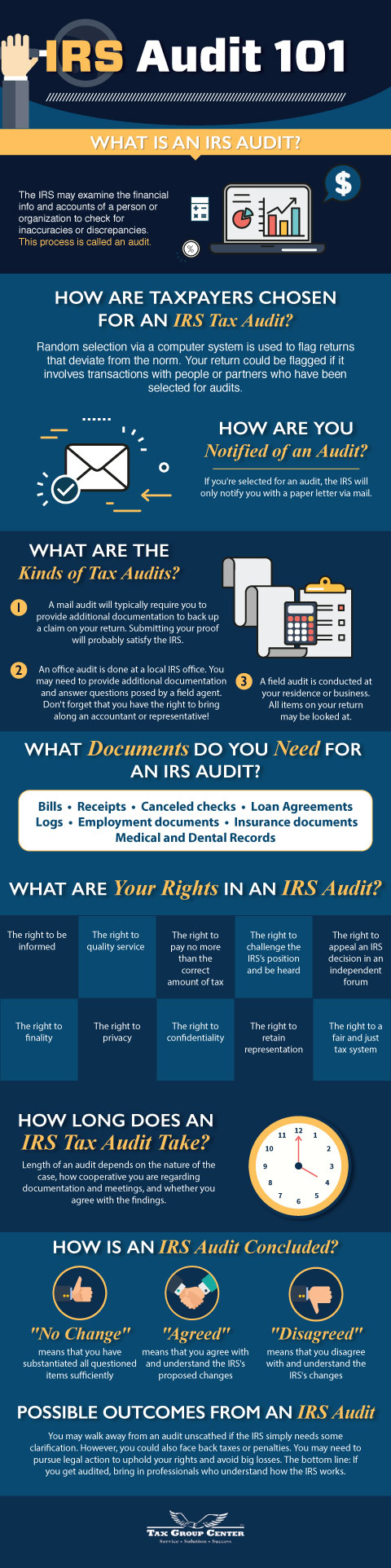

What Is an IRS Audit?

The IRS may examine the financial info and accounts of a person or organization to check for inaccuracies or discrepancies. This process is called an audit.

How Are Taxpayers Chosen for an IRS Tax Audit?

Random selection via a computer system is used to flag returns that deviate from the norm. Your return could be flagged if it involves transactions with people or partners who have been selected for audits.

How Are You Notified of an Audit?

If you’re selected for an audit, the IRS will only notify you with a paper letter via mail.

What Are the Kinds of Tax Audits?

- A mail audit will typically require you to provide additional documentation to back up a claim on your return. Submitting your proof will probably satisfy the IRS.

- An office audit is done at a local IRS office. You may need to provide additional documentation and answer questions posed by a field agent. Don’t forget that you have the right to bring along an accountant or representative!

- A field audit is conducted at your residence or business. All items on your return may be looked at.

What Documents Do You Need for an IRS Audit?

- Bills

- Receipts

- Canceled checks

- Loan agreements

- Logs

- Employment documents

- Insurance documents

- Medical and dental records

How Far Back Does an IRS Audit Go?

The IRS typically audits returns filed in the last three years. However, it can add additional years to an audit inquiry if major errors are discovered.

What Are Your Rights in an IRS Audit?

- The right to be informed

- The right to quality service

- The right to pay no more than the correct amount of tax

- The right to challenge the IRS’s position and be heard

- The right to appeal an IRS decision in an independent forum

- The right to finality

- The right to privacy

- The right to confidentiality

- The right to retain representation

- The right to a fair and just tax system

How Long Does an IRS Tax Audit Take?

Length of an audit depends on the nature of the case, how cooperative you are regarding documentation and meetings, and whether you agree with the findings.

How Is an IRS Audit Concluded?

- “No Change” means that you have substantiated all questioned items sufficiently

- “Agreed” means that you agree with and understand the IRS’s proposed changes

- “Disagreed” means that you disagree with and understand the IRS’s changes

Possible Outcomes From an IRS Audit

You may walk away from an audit unscathed if the IRS simply needs some clarification. However, you could also face back taxes or penalties. You may need to pursue legal action to uphold your rights and avoid big losses. The bottom line: If you get audited, bring in professionals who understand how the IRS works.

The IRS may examine the financial info and accounts of a person or organization to check for inaccuracies or discrepancies. This process is called an audit.

Share this Image On Your Site

<p><strong>Please include attribution to www.taxgroupcenter.com with this graphic.</strong><br /><br /><a href=’https://www.taxgroupcenter.com/irs-audit-101/’><img src=’https://www.taxgroupcenter.com/wp-content/uploads/2020/01/IRS_Audit_101_Infographic_V2-1.jpg’ alt=’IRS Audit 101′ 540px border=’0′ /></a></p>