A tax problem doesn’t have to haunt you forever. The IRS actually provides many options that taxpayers can use to settle tax debt, but it’s important to know what’s in front of you before you can decide how to move forward. Here’s how to find the right tax relief option for your tax situation.

How Do You Qualify for Tax Relief?

The fact that you’re a taxpayer qualifies you for one of the IRS’s tax relief programs, but you’ll need to look into the specific programs available to determine which one fits your needs. People who are unable to pay or file taxes due to circumstances like illnesses and natural disasters can qualify for relief. In addition, the IRS extends relief options to people who are struggling to pay tax bills.

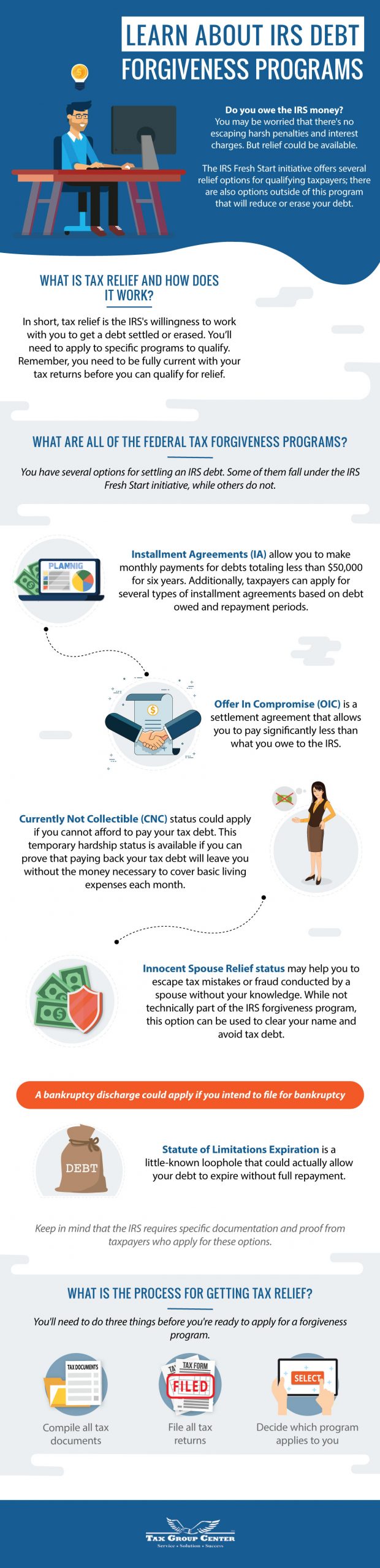

You’ll need to request the specific type of tax relief solution that applies in your situation. When you apply, the IRS will consider your ability to pay, your income, your expenses, and your assets.

How Do Tax Relief Services Work?

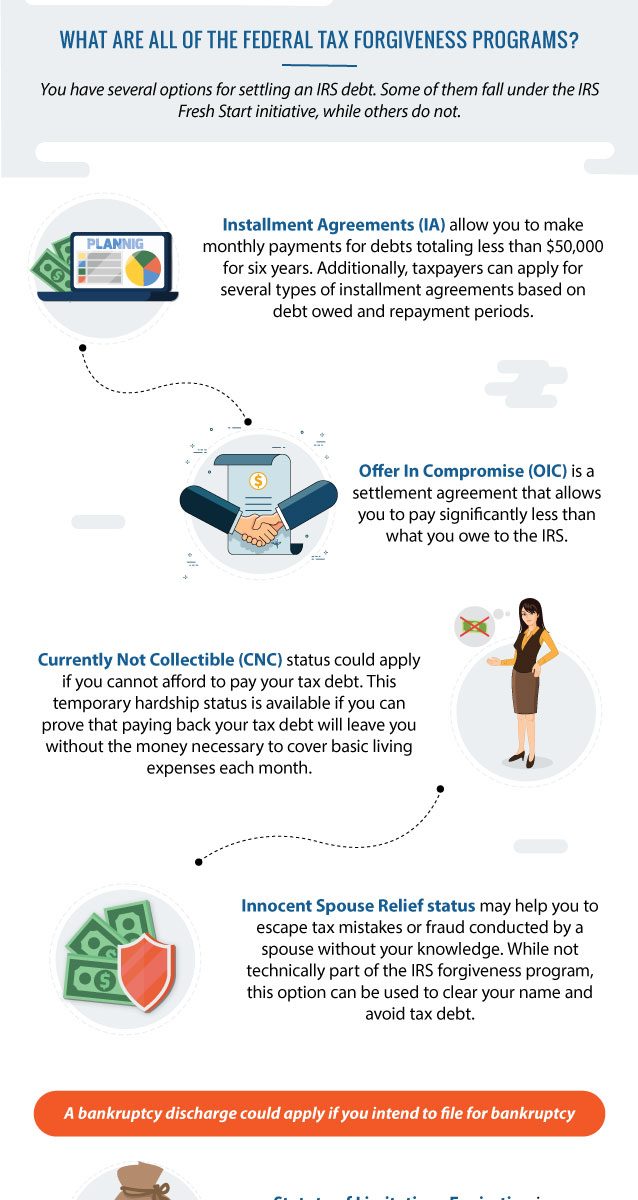

Relief doesn’t necessarily mean that your debt will be wiped away, but the IRS can be quite reasonable when it comes to making sure you can manage tax debt. The IRS will assess your ability to pay what you owe based on the financial information that you submit. There is a chance that the IRS will settle your debt for much less than you actually owe. In addition, your requirement to pay back your debt may be suspended if you can prove hardship. The IRS may also provide you with a payment plan that allows you to pay back what you owe using smaller payments over a period of about six years.

What Are Tax Relief Solutions That You Can Look Into?

The IRS offers a range of tax relief options. You’ll need to look into each option to decide which one applies to your situation. Here’s the list of options that may be available for you:

- Offer in Compromise (OIC)

- Penalty Abatement

- Installment Agreement (IA)

- Currently Non Collectible (CNC)

- Innocent Spouse Relief

- Audit Appeal

Bear in mind that the IRS will not consider you for any of its relief options if you’re not current with your tax returns.

The good news is that the IRS simply wants you to file any returns that you owe, and the fact that you filed returns late won’t impact your ability to qualify for available tax relief solutions. Of course, it’s highly recommended that you get those late returns filed promptly to avoid more tax issues going forward.

How Do You Determine Which Tax Relief Solution Is Right for You?

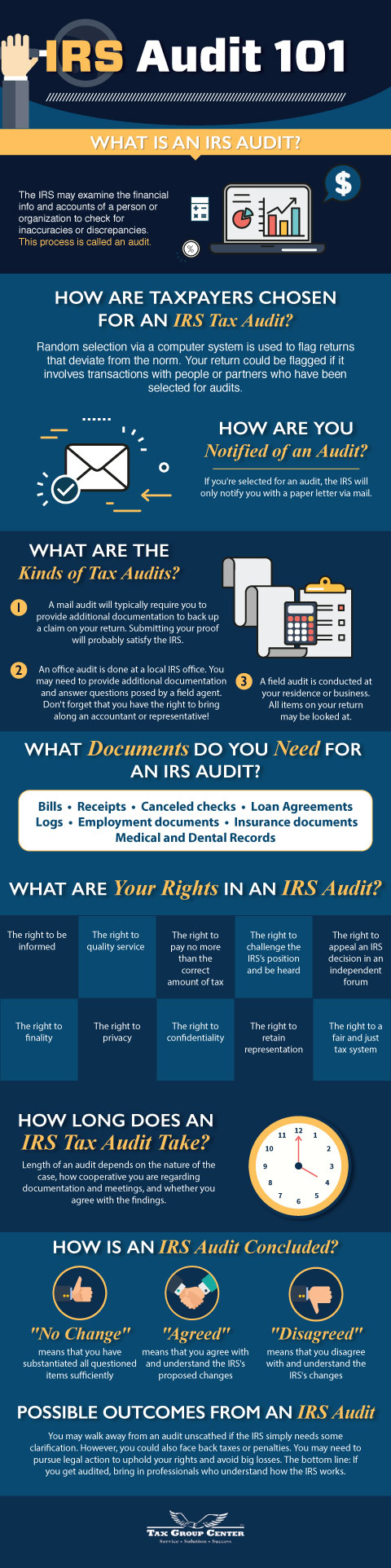

Most people aren’t very familiar with the IRS’s relief options. That’s why it’s highly recommended that you seek help from tax experts while deciding which program is right for you. Working with a tax team that deals with the IRS regularly will ensure that you take the right steps and avoid more penalties. One of the most important things a tax professional can do for you is take measures to get interest and penalties taken away. This includes very harsh penalties like tax levies, tax liens, and wage garnishments.

Most taxpayers who owe money qualify for Installment Agreements because the qualifications are pretty basic. You’ll just need to be willing to turn over financial information to the IRS that proves that you don’t have the cash or borrowing power to pay off your debt right now. You may be able to apply for a more robust relief option like Offer in Compromise or Currently Non Collectible if you can prove that making payments on your full debt total would create financial hardship.

Tax Group Center Can Help You Explore Your Relief Options

Tax Group Center helps our clients get access to tax relief solutions that can turn their entire lives around. Let us walk you through the options that are available to you; we’ll make sure you’re complying with the IRS’s requirements to make the process go as smoothly as possible. We’ll also help you get set up to make sure your repayment process is completed correctly. We have a team of licensed tax professionals, CPAs, and lawyers waiting to dedicate time and attention to your case. Call today!