Do you know what the deadline is for your next tax bill? Unlike typical employees, business owners and self-employed individuals need to pay quarterly taxes throughout the year. To further complicate matters, not all types of businesses share the same filing deadlines for tax returns.

Share this Image On Your Site

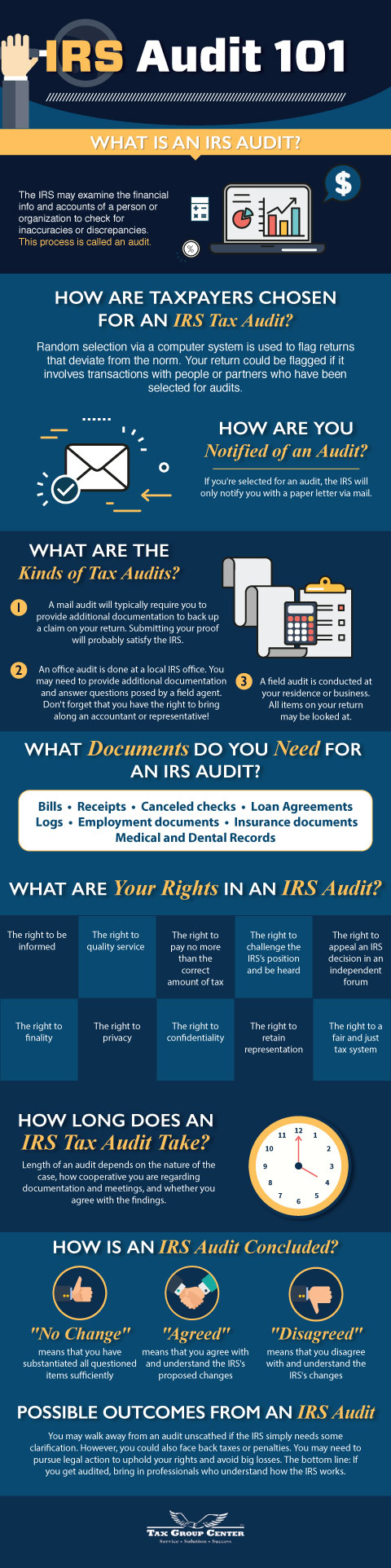

When Are Estimated Tax Payments Due in 2020?

Anyone who is a self-employed person serving as an independent contractor, sole proprietor, partner, or LLC member should be paying estimated quarterly taxes. Here are the due dates for quarterly taxes in 2020:

- Jan. 15

- April 15

- June 15

- Sept. 15

Don’t forget that your last quarterly payment for 2020 will be due January 15, 20201!

What Happens if You Don’t Pay Your Quarterly Taxes?

The IRS wants those quarterly taxes paid if you owe at least $1,000. The IRS will add on a penalty totaling 0.5 percent per month to any tax bill that isn’t paid by its due date. You’re also looking at an interest charge of three percent. It all adds up to being on the hook for nine percent extra if everything isn’t paid in full by April 15.

When Are Business Taxes Due?

- Tax returns for calendar year partnerships or limited liability companies with two or more members are due by March 15 of 2020.

When Are Corporate Taxes Due?

- Tax returns for S corporations are due by March 15 of 2020. Use Form 1120-S.

- Tax returns for calendar year C corporations are due by April 15 of 2020. Use Form 1120.

When Are Personal Taxes Due?

- Tax returns for personal income tax are due by April 15 of 2020. Use Form 1040 or Form 1040-SR.

- Tax returns for Schedule C sole proprietorships and Schedule F farming businesses are due by April 15 of 2020.

If you don’t think you’ll be able to file your return by its due date for 2020, you can apply for an automatic six-month filing extension. Just make sure the request is filed before your return is due.

What Happens if You Miss Your Tax Deadline?

Fines, penalties, audits, and jail time could all result from not filing tax returns on time.

- You will be faced with a late fee that can total as much as 25 percent of what you owe for the year if you don’t make your deadline.

- Failing to file within 60 days of your filing due date will result in a minimum penalty of $210 that can go all the way up to 100 percent of the unpaid taxes you owe.

- Your best bet is to connect with a tax professional if you think you’ll need a filing extension this year.

- Getting an extension the right way can ensure that you will have more time to get everything organized without being subjected to fees, penalties, and other consequences from the IRS.

People run into tax problems when they don’t have the funds to cover the amount. They might feel shame or frustration. Paying for everyday basics, such as groceries, may be the biggest concern. The taxes are put on the back burner until better days arrive.

People run into tax problems when they don’t have the funds to cover the amount. They might feel shame or frustration. Paying for everyday basics, such as groceries, may be the biggest concern. The taxes are put on the back burner until better days arrive. Although it may seem implausible, some people do forget to file their taxes. These individuals might work abroad or at charitable institutions. They don’t intend to skip one or two years of tax payments. The time frame just got away from them.

Although it may seem implausible, some people do forget to file their taxes. These individuals might work abroad or at charitable institutions. They don’t intend to skip one or two years of tax payments. The time frame just got away from them. People fall behind on their taxes because of a few, common situations, such as:

People fall behind on their taxes because of a few, common situations, such as: Falling behind on your taxes may be a case of a disorganized lifestyle. You don’t have the time to fill out the forms or figure out the credits. Throwing up your hands in frustration and scrapping the entire process is an excuse shared among many people. These adults must change their perception of taxes and pay them as needed. They’ll only save themselves from frustration in the end.

Falling behind on your taxes may be a case of a disorganized lifestyle. You don’t have the time to fill out the forms or figure out the credits. Throwing up your hands in frustration and scrapping the entire process is an excuse shared among many people. These adults must change their perception of taxes and pay them as needed. They’ll only save themselves from frustration in the end. The simplest way to pay your taxes through the year is by withholding them in a paycheck. You never see the funds. They’re simply tucked away for the government’s use. Be sure that you’re withholding enough funds to cover your taxes. Filing a form with your employer can make the process a simple one. You can withhold any amount that you desire.

The simplest way to pay your taxes through the year is by withholding them in a paycheck. You never see the funds. They’re simply tucked away for the government’s use. Be sure that you’re withholding enough funds to cover your taxes. Filing a form with your employer can make the process a simple one. You can withhold any amount that you desire.