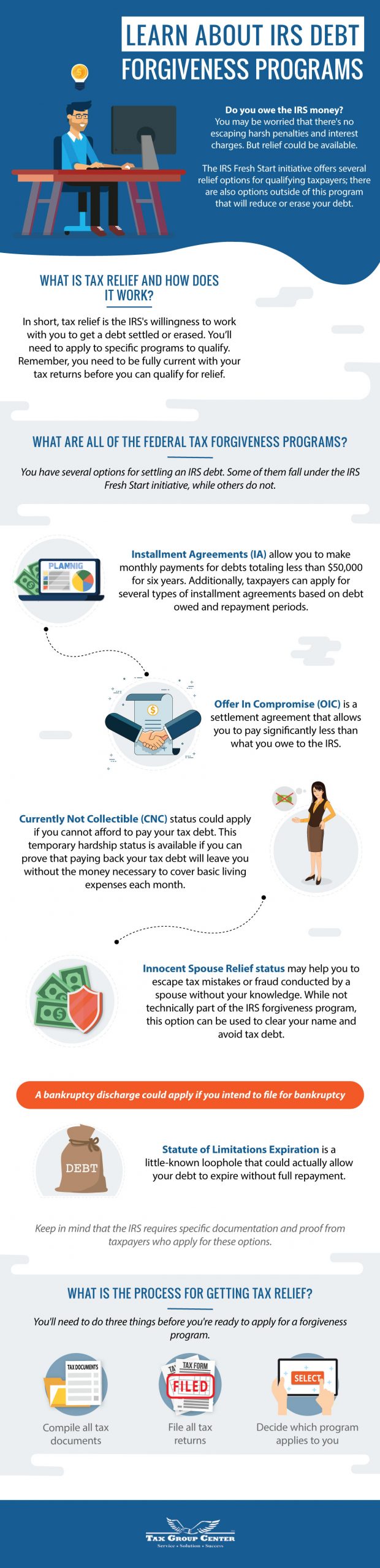

One common myth is that the IRS will never negotiate with someone who owes money. In reality, the IRS offers official channels for debt negotiation as part of its Fresh Start program. Are you unsure about how to negotiate your debt with the IRS because you’re unfamiliar with relief options? Let’s discuss three popular options that make it possible to negotiate your tax debt without incurring new penalties.

Can You Negotiate Your Tax Debt With the IRS?

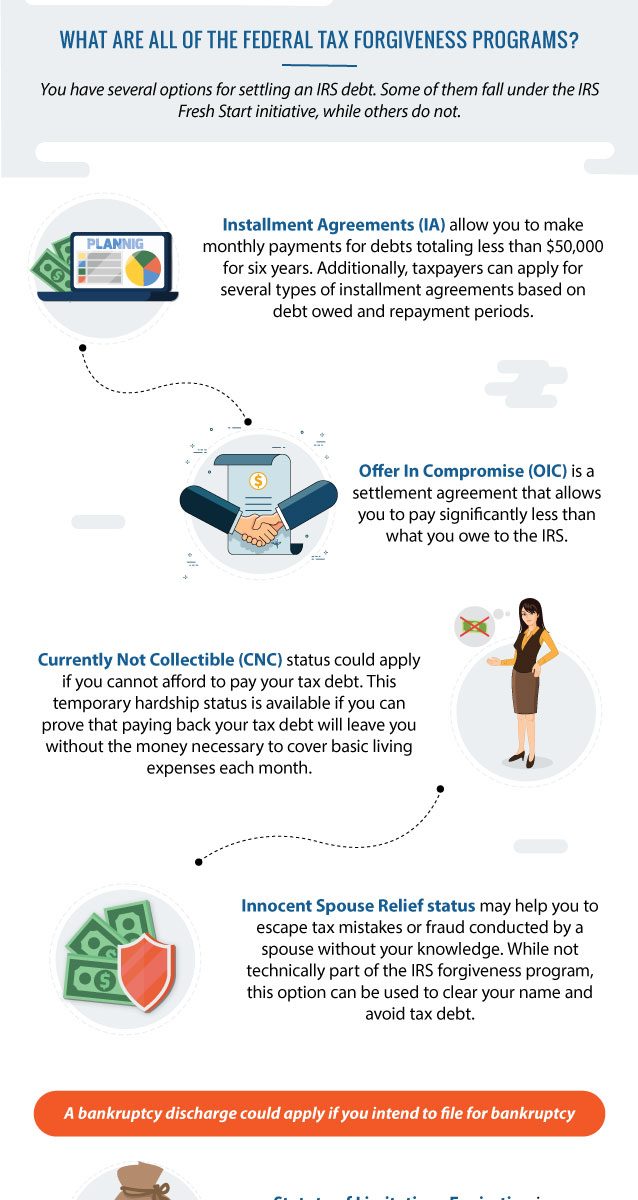

Yes, you have several options for negotiating a tax debt. There’s no guarantee that the IRS will approve your request for debt relief. However, there’s a good chance that you’ll qualify for an option that at least creates a manageable way to pay what you owe. Here are three options that should be on your radar if you owe money:

- Offer in Compromise (OIC).

- Installment Agreements (IA).

- Penalty Abatement.

It’s important that you have a grasp on your current financial status before you pursue one of these options. The IRS will examine your finances closely to gauge your ability to pay what you owe. Additionally, you must be current with all tax returns before the IRS will even consider negotiating with you. Don’t be discouraged if you haven’t filed all previous tax returns. The IRS simply wants you to get up to date as quickly as possible. Yes, you should file even if you cannot pay what you owe.

Offer in Compromise

An Offer in Compromise (OIC) allows you to settle your owed taxes for less than what you owe. The IRS is looking for you to prove that you cannot reasonably pay your full tax liability before it reaches its expiration date. Most tax liabilities reach a statue after 10 years (120 months). As a result, the IRS will often reduce your debt as a way to at least get something from you. Here’s the full list of what the IRS takes into consideration when reviewing your application:

- Your income.

- Your expenses.

- Your asset equity.

- Your ability to pay.

You will submit an OIC offer to the IRS based on what you can reasonably afford to pay. The IRS weighs your monthly income against your reasonable collection potential to determine how much it will excuse from your tax liability. In addition, all liens will be removed once your offer is approved.

The IRS will expect a “lump” payment when you submit your offer. This payment can either reflect 20 percent of your offer amount or one standard monthly payment. It’s important to know that your OIC will only remain valid if you stay current with payments and file all future tax returns on time. The IRS will return any filed Offer in Compromise (OIC) application that does not contain all of the necessary information and estimated payments. However, the IRS will keep and apply any initial payment to reduce your balance. It’s very important to get help from a tax professional to ensure that your application is submitted properly to avoid rejection or delays. This is especially true when you consider that liens can be applied up until your application is approved.

Installment Agreements

The IRS may approve you for an installment agreement. This is actually the most common form of debt relief available. To qualify, you must prove that you don’t have the available cash, borrowing power, or equity to pay back what you owe to the IRS. The IRS will ask you to fill out forms detailing your income, debt, assets, and liabilities. You shouldn’t expect the IRS to offer much wiggle room if your finances reflect an ability to pay back the IRS debt that you owe.

Entering into an installment agreement with the IRS typically means that you’re agreeing to pay back what you owe over a period spanning six years. The big perk of an installment agreement is that you’re able to pay off your debt in manageable monthly installments without incurring penalties and fees. You’re also avoiding liens or wage garnishments that could hurt your credit score and financial reputation.

It’s important that you commit to making all payments on time once you’ve been approved for an installment agreement. Unfortunately, missing a payment means that you’ve violated the terms of your agreement. Violating agreement terms gives the IRS the right to move forward with seizing property and attaching liens.

Penalty Abatement

Do you feel that penalties have been harshly or unfairly assigned to your IRS bill? You may be in a position to petition for something called penalty abatement. Penalty abatement does not address any original tax debt or accumulated interest. It does address penalties that have been tacked on to your existing debt and interest. You have a few different ways to go about requesting penalty abatement. One option is a First-Time Penalty Abatement (FTA). This abatement applies if you have accrued penalties for failing to file your return on time, pay on time, or deposit taxes when due. Here’s what it takes to qualify:

- You didn’t previously have to file a return.

- You have no penalties for three tax years prior to the penalty year.

- You filed all currently required returns or an extension.

- You have paid or arranged to pay due taxes.

Another option is Reasonable Cause Penalty Relief. Did you fail to file or pay taxes because of a life event or natural disaster? The IRS will consider any sound reason presented for your failure to file a tax return, make a deposit, or pay due taxes. Here’s a rundown of causes that often qualify:

- Fire, casualty, or natural disaster.

- Inability to obtain records.

- Death, serious illness, or unavoidable absence of the taxpayer or immediate family member.

- Any reason that establishes that you used all ordinary care and prudence to meet your tax obligations to the best of your ability.

A lack of funds doesn’t count as a reasonable cause for failing to pay owed taxes. However, the criteria may be met if a lack of funds was caused by any of the factors listed above. Be prepared to back up all claims regarding a reasonable cause with documentation. The IRS will likely conduct an investigation to confirm your claim if you try to obtain Reasonable Cause Penalty Relief.

Find the Right Option for How to Negotiate Tax Debt With IRS Agents

Yes, the IRS will probably be willing to negotiate with you if you’ve failed to file or pay taxes for some reason. It’s so important to get ahead of the problem if you owe the IRS money. Tax Group Center is here to help you begin communication with the IRS for getting your tax debt reduced or sliced into payments. Our team can also pursue penalty abatement to help you avoid paying steep sums to the IRS. Our team of tax professionals, lawyers, and CPAs will help you discover and pursue the best option for your case. Additionally, we’ll help you stay on track with preparing your taxes on time and keeping up with payments to avoid the nullification of your relief plan. Give us a call today if you need a plan for settling a debt with the IRS. We help people negotiate tax debt with the IRS every day using the IRS’s own language.