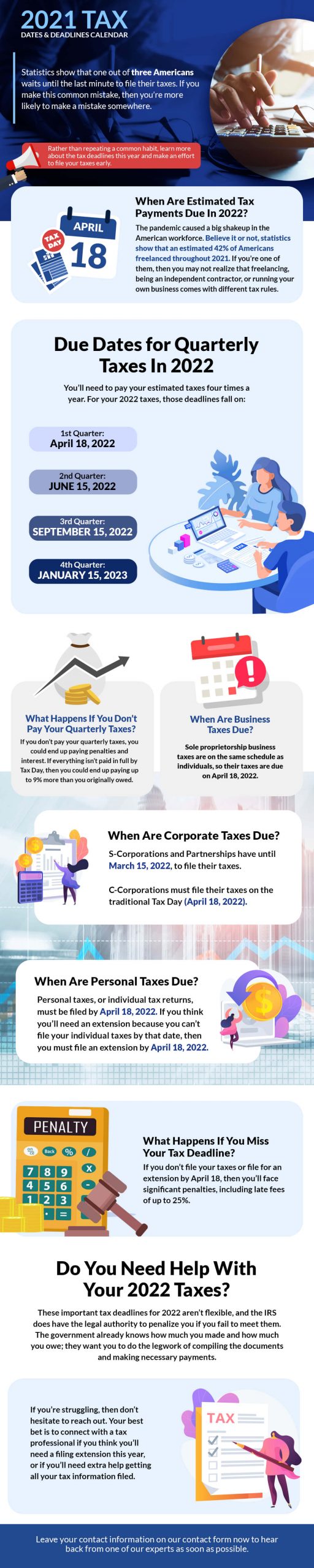

Statistics show that one out of three Americans waits until the last minute to file their taxes. If you make this common mistake, then you’re more likely to make a mistake somewhere.

Rather than repeating a common habit, learn more about the tax deadlines this year and make an effort to file your taxes early.

When Are Estimated Tax Payments Due In 2022?

The pandemic caused a big shakeup in the American workforce. Believe it or not, statistics show that an estimated 42% of Americans freelanced throughout 2021. If you’re one of them, then you may not realize that freelancing, being an independent contractor, or running your own business comes with different tax rules.

Due Dates for Quarterly Taxes In 2022

You’ll need to pay your estimated taxes four times a year. For your 2022 taxes, those deadlines fall on:

- 1st Quarter: April 18, 2022

- 2nd Quarter: June 15, 2022

- 3rd Quarter: September 15, 2022

- 4th Quarter: January 15, 2023

What Happens If You Don’t Pay Your Quarterly Taxes?

If you don’t pay your quarterly taxes, you could end up paying penalties and interest. If everything isn’t paid in full by Tax Day, then you could end up paying up to 9% more than you originally owed.

When Are Business Taxes Due?

Sole proprietorship business taxes are on the same schedule as individuals, so their taxes are due on April 18, 2022.

When Are Corporate Taxes Due?

S-Corporations and Partnerships have until March 15, 2022, to file their taxes. C-Corporations must file their taxes on the traditional Tax Day (April 18, 2022).

When Are Personal Taxes Due?

Personal taxes, or individual tax returns, must be filed by April 18, 2022. If you think you’ll need an extension because you can’t file your individual taxes by that date, then you must file an extension by April 18.

What Happens If You Miss Your Tax Deadline?

If you don’t file your taxes or file for an extension by April 18, then you’ll face significant penalties, including late fees of up to 25%.

Do You Need Help With Your 2022 Taxes?

These important tax deadlines for 2022 aren’t flexible, and the IRS does have the legal authority to penalize you if you fail to meet them. The government already knows how much you made and how much you owe; they want you to do the legwork of compiling the documents and making necessary payments.

If you’re struggling, then don’t hesitate to reach out. Your best bet is to connect with a tax professional if you think you’ll need a filing extension this year, or if you’ll need extra help getting all your tax information filed. Leave your contact information on our contact form now to hear back from one of our experts as soon as possible.